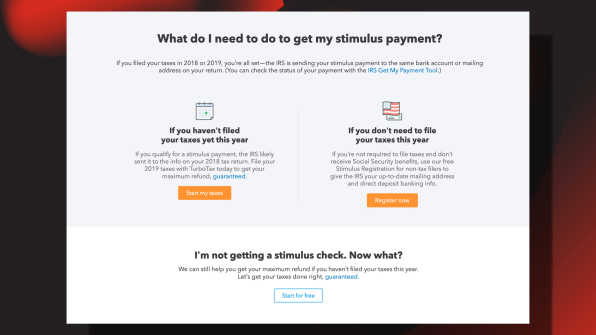

You can also use one of Code for America’s filing tools: visit through October 1, 2022, if you missed the first or second stimulus checks. Tax software, such as MyFreeTaxes, H&R Block, or TurboTax, will automatically help determine if you qualify for the Recovery Rebate Credit. The tax filing extension deadline is October 17, 2022. The deadline to file your tax return was April 18, 2022. You will need to file a tax return for Tax Year 2021 (which you file in 2022). To learn more about your options if you think you owe taxes, read “ Filing Past Due Tax Returns” and “ What to Do if I Owe Taxes but Can’t Pay Them.” Third Stimulus Check The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. If you don’t owe taxes, there is no penalty for filing late. If you missed the filing deadline, you can still file your tax return to get your first and second stimulus checks. The tax filing extension deadline is October 15, 2021. The deadline to file your taxes this year was May 17, 2021. You will need to file a tax return for Tax Year 2020 (which you file in 2021).

Visit before mid-November to get the third stimulus check only.

Visit through October 1, 2022, to get the first or second stimulus checks (or a combination of missed stimulus checks). See the chart below to identify which free filing options you can use. The tax return you need to file will depend on which stimulus checks you need to get. You can get the Recovery Rebate Credit by filing your taxes. How do I claim the Recovery Rebate Credit on my tax return?

0 kommentar(er)

0 kommentar(er)